- Introduced in 2019, Apple Card provides nice advantages for shoppers, together with fast coins again and no charges.

- Whilst Apple Card doesn’t have a industry choice, solopreneurs and small industry house owners who use non-public credits to fund industry bills can benefit from the rewards.

- Apple Card is a Mastercard issued via Goldman Sachs; as such, maximum small companies can settle for it as a fee manner from consumers.

- This newsletter is for small industry house owners keen on Apple Card, both to just accept as fee or to make use of for small industry purchases.

Apple Card introduced in 2019 with a set of options that appeals to each Apple-product fanatics and people who don’t use iPhones, Apple Watch or different electronics from the tech large.

Editor’s be aware: Desire a bank card processor for what you are promoting? Fill out the under questionnaire to have our seller companions touch you with unfastened knowledge.

Despite the fact that the corporate doesn’t be offering a industry bank card, Apple Card’s distinctive options is also recommended for self-employed people and small industry house owners. Right here’s what Apple Card provides and the way you’ll put it to give you the results you want.

>>Learn subsequent: Fee Fraud Affects 293 Million Other people — Is Your SMB Protected?

Symbol credits: Apple

Contents

- 1 What’s Apple Card?

- 2 What are Apple Card’s charges and lines?

- 3 What are some great benefits of Apple Card for small companies?

- 4 1. Apple Card provides spending insights which are simple for solopreneurs to trace.

- 5 2. Monetary well being equipment hooked up to Apple Card can lend a hand small companies.

- 6 3. Companies can save on bank card charges with Apple Card.

- 7 Can small companies settle for Apple Card?

- 8 Apple Pay and Apple Card is also the long run

What’s Apple Card?

Apple Card is a rewards-based bank card that provides shoppers coins again on quite a lot of classes of purchases. As a result of Apple pushes the cardboard as a part of its ecosystem, customers reap extra rewards after they purchase Apple merchandise and use Apple Pay on their iPhones to pay for purchases. However consumers nonetheless get a 1 p.c praise in the event that they use the cardboard for different purchases. Money-back rewards are deposited day by day — no longer per thirty days, like with maximum playing cards — below “Day-to-day Money” within the Apple Pockets app.

“It’s no longer a nasty card,” mentioned Chris Kuiper, director of analysis at Constancy Virtual Belongings. “It’s were given coins again. It’s were given 1 p.c on the whole lot — 2 p.c should you use Apple Pay, which is turning into a larger factor, and three p.c on Apple merchandise. However for the entire different advantages, different playing cards already be offering them, or you’ll get specialised playing cards for the ones issues.”

Alternatively, along with the use of Apple Card with Apple Pay, shoppers can use a bodily model of the cardboard for purchases from distributors that don’t settle for Apple Pay. It’s a swish titanium card with the buyer’s title etched into the outside. The cardboard is particularly devoid of alternative knowledge, such because the bank card quantity, CVV quantity, expiration date and signature field.

What are Apple Card’s charges and lines?

In a useful transfer for shoppers, Apple Card doesn’t price past due charges, annual charges, cash-advance charges, world charges, over-limit charges, financing charges or any of the opposite pesky charges different bank card issuers price. The Pockets app displays the cardholder precisely the place and how much cash used to be spent and routinely breaks down spending into color-coded classes. Money-back rewards are allotted day by day and can also be spent straight away.

In October 2022, Apple introduced there might be a brand new high-yield financial savings account characteristic to be had to Apple Card customers. This serve as used to be meant to be launched with iOS 16.1, but it surely nonetheless hasn’t been introduced as of April 2023.

Within the period in-between, all the gadget is designed to offer consumers extra keep an eye on over how a lot they spend and get again, mixed with the versatility of the use of the iPhone with Apple Pay for purchases and the bodily Apple Card at puts that don’t settle for Apple Pay. Thousands and thousands of shops now settle for Apple Pay, and Insider Intelligence/eMarketer forecasts that 56.7 million other folks might be the use of it through 2026, up from 45.4 million in 2022.

Apple Card provides a zero-fee construction, fast cash-back rewards and a swish design that matches in neatly with different Apple merchandise.

What are some great benefits of Apple Card for small companies?

Observers be aware some decent and distinctive, if no longer progressive, touches to Apple Card, similar to device studying and geolocation monitoring of your spending. Those options is also thrilling for shoppers, however what about small companies?

Rivka Gewirtz Little, CEO of virtual id verification corporate Socure, mentioned Apple must “do one thing to make Apple Card extra related” for small firms as a result of, in spite of “some great and usable parts, this can be a client product. This doesn’t seem to be a industry or company providing.”

Nevertheless, Little mentioned there are some sexy control and visibility options that would receive advantages very small firms and solopreneurs who don’t thoughts the use of non-public playing cards for industry bills.

Symbol credits: Apple

1. Apple Card provides spending insights which are simple for solopreneurs to trace.

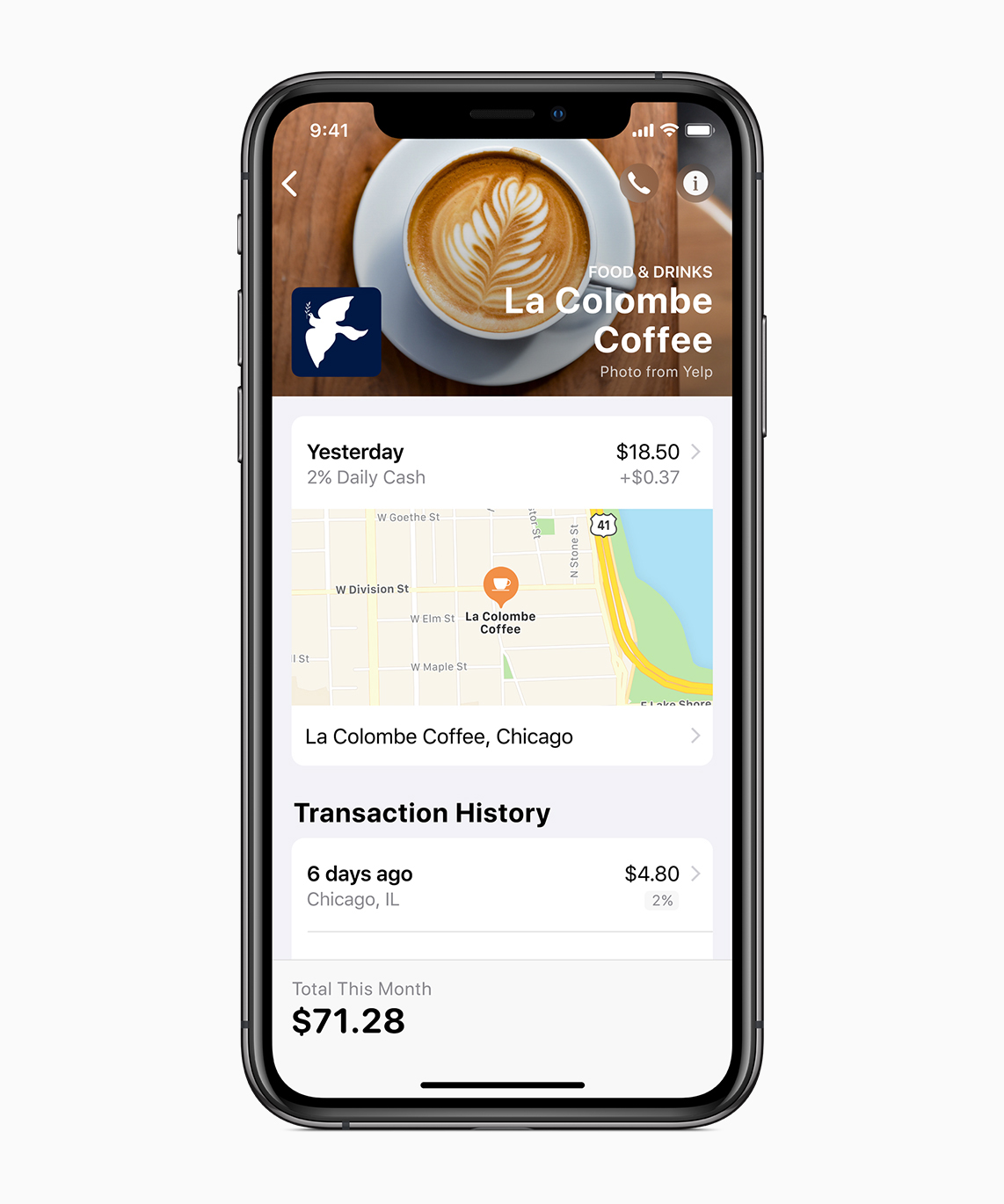

While you use Apple Card, it will give you experiences of the place and the way you spent your cash. Those are simple to get entry to in the course of the Pockets app or the Apple Card web page. Integrated fraud coverage and immediate sign-up and deployment may additionally throw Apple Card into the plus column for extraordinarily small industry operations, because it cuts again the ready time normally had to get a bank card up and working.

However there are limits to these benefits. “There are some great options when it comes to manageability and visibility of spending, so should you’re actually a small corporate, it would let you,” Little mentioned. “However when you have various other folks, then you wish to have to have a view of what everyone seems to be spending to your corporate card, and at that time you’re going to desire a procurement card and a few kind of control app.” [See the top expense trackers.]

2. Monetary well being equipment hooked up to Apple Card can lend a hand small companies.

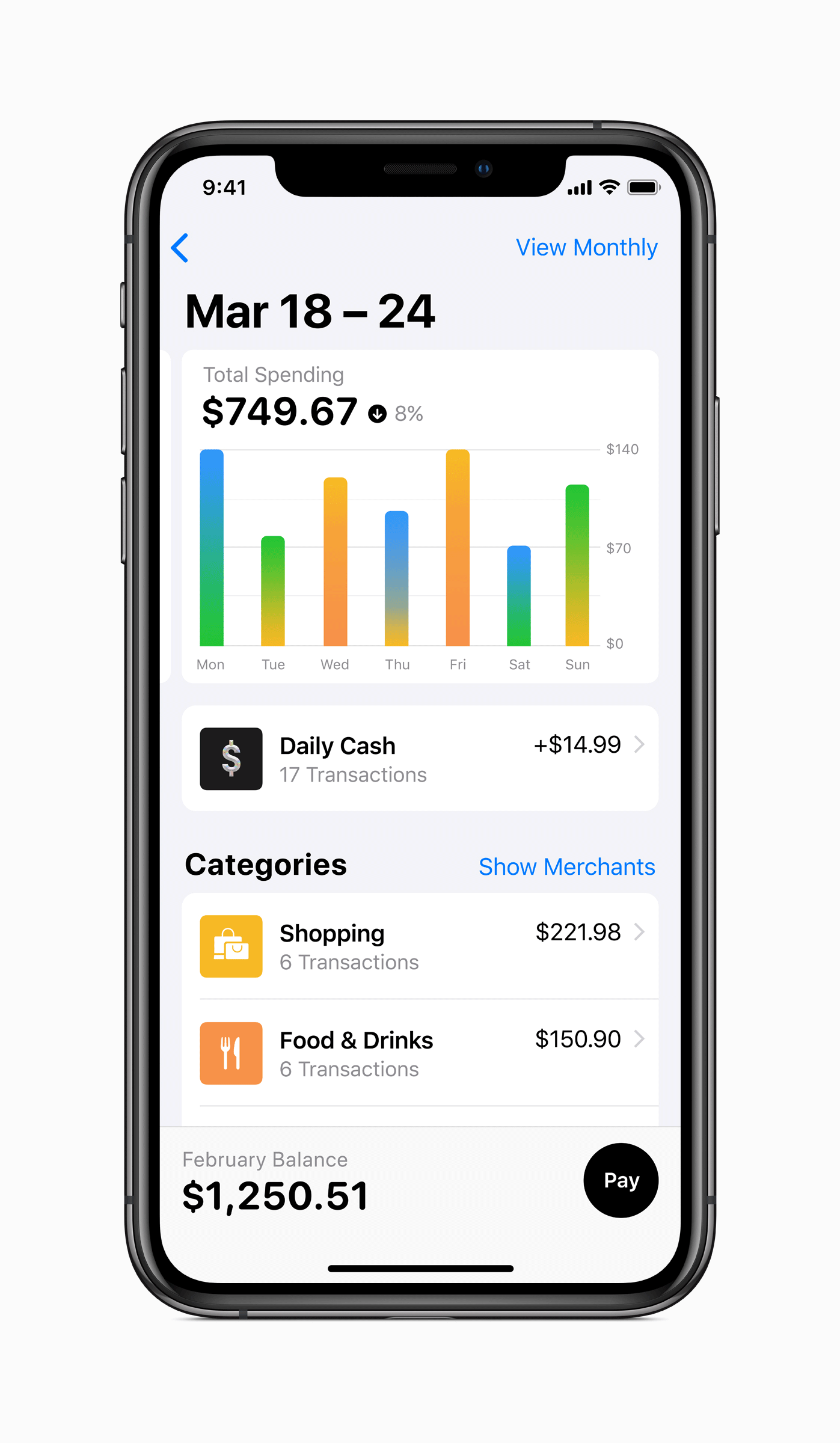

Lisa D. Ellis, spouse and senior fairness analyst at MoffettNathanson, mentioned Apple Card’s reporting equipment set it with the exception of different co-branded bank cards just like the Amazon bank cards, PayPal Money Card and Nordstrom Card.

“The principle differentiator of Apple Card is that Apple [has] a collection of ‘monetary well being’ equipment tied to the cardboard, analogous to the ‘bodily well being’ equipment Apple has tied to Apple Watch, like tracking your center fee or monitoring steps,” Ellis mentioned. “The monetary well being equipment … permit the cardholder to higher monitor bills [and] arrange credits.”

Even though industry house owners are the use of best accounting tool, the monetary equipment to be had with Apple Card is also useful for purchasing a take a look at what you are promoting’s financial well being from a special vantage level.

3. Companies can save on bank card charges with Apple Card.

Bank card charges can briefly upload up, hanging a burden on a solopreneur who’s already sparsely gazing their spending. As a result of Apple Card doesn’t price the numerous charges that different industry and private bank cards do, solopreneurs can extra conveniently — and strategically — use it to make very important industry purchases.

Whilst Apple Card isn’t presented as a conventional industry bank card, solopreneurs and self-employed people would possibly to find the monetary insights, expense monitoring and no-fee perks useful.

Can small companies settle for Apple Card?

Small companies that need to settle for Apple Card would possibly already be ready to take action if they’ve somewhat new bank card processing apparatus that incorporates EMV era and NFC talents, which permit them to just accept chip playing cards and contactless bills. In the event you simplest have a chip card reader, your consumers can use that to pay with the bodily Apple Card. [Check out our best credit card processing recommendations to learn more about this equipment.]

“In relation to small companies accepting the cardboard, it [is] run via Goldman Sachs and the Mastercard community, so … the true query is whether or not they need to combine the entire Apple Pay gadget,” Kuiper mentioned. “That’s simply going to come back all the way down to how a lot comfort they would like for his or her consumers and if they suspect that’s going to open up an entire new swath of clientele or consumers that they wouldn’t have sooner than — like, would somebody pop into one retailer over any other as a result of they settle for Apple Pay or don’t?”

One incentive to combine Apple Pay and different cellular wallets is the emerging passion in contactless bills. Utilization of contactless bills rose in line with the COVID-19 pandemic and shoppers’ higher choice to faucet their iPhone or Apple Watch as an alternative of touching shared surfaces.

Small companies can settle for the bodily Apple Card the use of a chip card reader and the Apple Pay model the use of a contactless card reader.

Apple Pay and Apple Card is also the long run

Some mavens take a distinctly positive view of the whole Apple Card zeitgeist as a result of accepting the cardboard is a simple procedure for small firms, particularly the ones accustomed to Apple Pay.

“For small companies and shops that function on-line and already settle for Apple Pay, this can be a large receive advantages, as shoppers might be frightened to make use of the cardboard and start buying groceries on-line at collaborating shops,” mentioned Bart Mroz, CEO of SUMO Heavy, a consulting company that specialize in virtual trade technique, design and construction.

For companies that don’t but strengthen Apple Pay, the titanium card’s hyperlink with Mastercard encourages its use, widening the opportunity of further consumers and income.

No matter judgments small firms will have about Apple Card, they are able to be certain that of positive advantages: fewer charges and immediate rewards. Past that, while you’re ready to just accept bills your consumers make with Apple Card and Apple Pay, you give them the benefit of the use of their most popular fee manner at what you are promoting. That’s a win-win.

Rebecca Neubauer and Jackie Dove contributed to this text. Supply interviews have been performed for a prior model of this text.

Supply By means of https://www.businessnewsdaily.com/15006-apple-credit-card-financing.html